Responsible AI Lending: Balancing Innovation and Compliance

- Sep 9, 2025

- 5 min read

Introduction: A Turning Point for AI in Finance

Artificial Intelligence (AI) has quickly moved from lab experiments to everyday financial applications. Chatbots now resolve customer queries, machine learning models power fraud detection, and generative AI tools prepare loan summaries. Globally, investments in AI across banking, insurance, and capital markets are expected to exceed ₹8 lakh crore by 2027, with generative AI growing at 28% to 34% annually this decade.

In India, the Reserve Bank of India (RBI) has recognized this momentum. Through the FREE-AI (Framework for Responsible and Ethical Enablement of AI) report released on 13th August, RBI set a clear vision: AI is inevitable, but it must be adopted responsibly. The framework stresses trust, fairness, accountability, explainability, and resilience as must-haves.

For NBFCs and banks, especially in the mid-market segment, the choice is no longer whether to adopt AI. The real question is how to use it in lending while balancing innovation, compliance, and customer trust.

Why AI in Lending Matters Now

Lending is one of the most AI-ready areas in financial services:

Efficiency: AI speeds up loan approvals, automates document checks, and supports 24/7 customer service through chatbots.

Alternate Credit Scoring: AI uses utility bills, GST filings, mobile usage, or e-commerce history to assess “thin-file” or new-to-credit borrowers.

Fraud and Risk Management: Machine learning spots anomalies faster than rules-based systems, reducing losses.

Personalization: Multilingual and voice-enabled AI tools help lenders reach India’s diverse customer base.

The RBI’s own survey highlights the opportunity. Top use cases include customer support (15.6%), credit underwriting (13.7%), and cybersecurity (10.6%).

Among regulated entities, SCBs and NBFCs are adopting AI steadily (52% and 27% respectively). Nearly two-thirds are already testing at least one generative AI use case, often through pilots such as internal chatbots.

Institutions that avoid AI risk falling behind more agile peers. They may also struggle to counter AI-driven fraud or serve the growing new-to-credit segment. RBI itself warns of the danger of “AI inertia” - falling behind by not adopting new technology.

The Balancing Act: Innovation and Risk

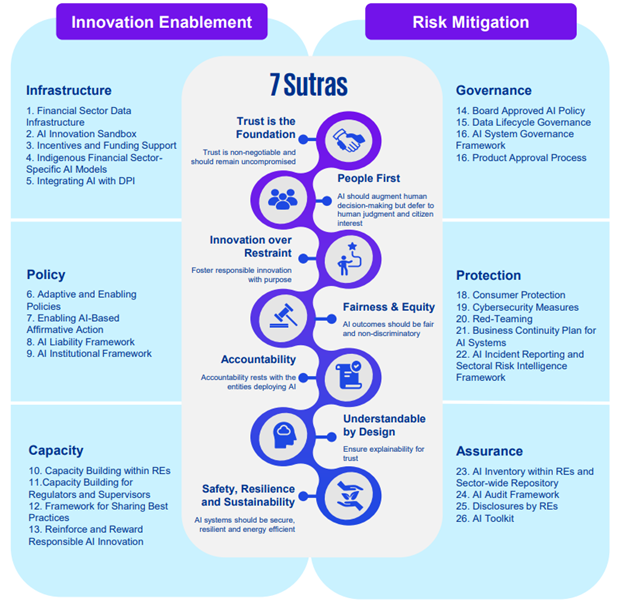

The RBI’s FREE-AI framework sets out seven guiding principles, or “Sutras,” for AI in financial services. These are further expanded into six pillars and 26 recommendations covering the two broad areas: Innovation Enablement and Risk Mitigation.

These principles are especially important in lending, where every credit decision carries high stakes. A loan approval or rejection can shape livelihoods, businesses, and financial stability. When AI models make these decisions, institutions face key challenges:

Bias and fairness: Could skewed data exclude certain groups?

Explainability: Can lenders give borrowers a clear reason when a loan is declined?

Accountability: Who is responsible if an AI system makes a mistake—the vendor, developer, or the bank?

Operational risk: How can lenders prevent systems from drifting, failing silently, or being hacked?

RBI’s position is clear: innovation and risk management must go together. A pro-innovation stance is preferred, but it must rest on accountability and consumer protection.

Recommendations that Boost Adoption

Some RBI recommendations that will help drive both AI adoption and sector growth include:

Incentives and Funding Support: To build shared infrastructure such as compute power, data lakes, and AI labs open to all REs, not just large banks.

Financial Sector Data Infrastructure: Linked with the IndiaAI “AI Kosh” initiative, this will provide standardized, high-quality datasets for training and testing AI models.

Industry-Level AI Sandboxes: Safe, collaborative spaces where REs can test AI models for credit, fraud, or customer service under regulatory oversight.

Light-Touch Compliance for Inclusion-Focused Lending: Reduced regulatory burden for small-ticket loans and AI models aimed at inclusion, to encourage experimentation.

What Executives Should Start Preparing For

Not all recommendations need immediate action, but some require early planning. Senior leaders should start preparing now:

Draft a Board-Approved AI Policy

Define principles, scope, and governance.

Classify AI use cases by risk (low, medium, high).

Assign clear responsibilities at board and senior management levels.

Strengthen Data Infrastructure and Governance

Map and clean internal data sources for integration with sectoral data systems

Build processes for bias testing, lifecycle management, and audits.

Maintain an inventory of all AI models, updated at least every six months.

Pilot AI in Controlled Environments

Select 1–2 use cases (e.g., underwriting, fraud detection) and test them in sandbox settings.

Document learnings, risks, and consumer outcomes before live rollout.

Join industry-level sandboxes once available.

Build Explainability Early

Work with partners to embed explainability tools in credit systems.

Train staff to explain “reason codes” when loans are denied.

Treat explainability as a trust driver, not just a compliance step.

Invest in People and Skills

Train management, risk, and product teams on AI and risk.

Identify gaps needing external support (e.g., data science, governance).

Encourage teams to join industry groups and RBI consultations.

These steps will prepare REs to act quickly once regulations are finalized, while also building trust and resilience. Early movers will gain an advantage when adoption accelerates.

OneFin as the Strategic Bridge

OneFin can step in as a transformation partner for REs to help them get ahead. Some of our notable AI-powered tools include:

Compliance/Regulatory Report Generator

Applicant/Credit Documentation Analyzer

Configuration AI Assistant

GenAI Chatbot for Customer Support

Our API-first lending infrastructure is designed to balance compliance with innovation. The platform is built around a few key facets:

Compliance-first: Embedding governance, auditability, and transparency into the lending process.

API-native and modular: Giving institutions flexibility to adopt and scale AI-enabled lending at their own pace while tapping into various tools and data sources

Innovation-ready: Safe environments for testing, and support for integration with digital public infrastructure.

Scalable and future-proof: Built to evolve as regulatory expectations and AI capabilities grow.

For NBFCs and banks, OneFin acts as a strategic bridge. It reduces compliance risk through built-in controls, while enabling the organization to innovate.

Closing Vision: Building the Bridge

AI will shape the future of lending in India - but it must be responsible AI. The winning formula is innovation balanced with accountability, trust, and stability.

Compliance is only the starting point. Advantage will come from going further and designing lending systems that are transparent, inclusive, and resilient. Institutions that achieve this balance will protect trust and unlock the next wave of growth in India’s financial sector.

Technology partners like OneFin will play a central role in this. Modern Loan Origination (LOS) and Loan Management (LMS) systems can embed compliance guardrails, enable AI innovation, and ensure auditability. To know more, schedule a Demo here.

For those seeking beauty, peace, and heritage in one setting, Seville has something truly special to offer. The gardens of Seville are a delightful escape where time slows down and nature tells stories of centuries past.